Can I get Your Number? Optimising Marketing Permissions in Retail Banking

Posted: 23/10/2023

What was the business context?

A major high-street bank wanted a new pan-bank strategic approach to how they obtain and maintain marketing permissions. This approach needed to be balanced across three pillars:

- Regulatory compliance: Ensuring marketing permissions are obtained in a way that complies with regulation

- Customer Experience: Providing customers with understandable disclosure of how their data will be used and offering clear, granular choices

- Commercial Value: Ensuring that the permissions approach enables the bank to market to a large number of customers.

With millions of pounds on the line and lots of stakeholder interest around the bank, they needed strong evidence that the approach they would ultimately develop is the right one. That called for high quality research, proving what works at scale and in the real world.

What were the research challenges?

We wanted to understand customer decision-making in two contexts: one where choosing marketing permissions was the primary task with the customers’ full attention, such as managing their privacy settings in a banking app, and one where choosing permissions was a secondary or tertiary decision, such as providing marketing permissions towards the end of a lengthy account opening process.

In the latter case, customers are paying little attention to the decision; may be fatigued or low on cognitive resources; and may view the permissions decision as less important than other choices they have to make. As such, the “say-do gap” in traditional surveys and interviews would be particularly acute, as those approaches fail to replicate the conditions in which the consumer is making their choices.

How did we tackle the research?

We used our Behaviourlab platform to build and execute a series of behavioural randomised controlled trials (RCTs). We recreated an accurate replica of the two different decision contexts to observe customer behaviour across those settings. We followed up with questions to measure other outcomes of interest (objective comprehension and subjective perceptions of the experience) and to profile each research participant.

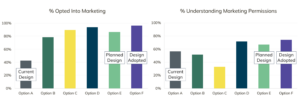

Within each context we tested three core designs: Opt-Out, Opt-In, and Active Choice where a customer is presented with a ‘Yes’ and a ‘No’ option for each permission and must provide an answer in order to continue (Figure 1). By not having a default response, Active Choice introduces deliberate friction into the journey to engage attention and prompt a moment of reflection. Within these core designs we trialled more than 30 variations. Over 14,000 consumers and small businesses participated, enabling insights into the behaviour of specific sub-groups including customers in vulnerable circumstances.

Figure 1 – Marketing Preferences: Active Choice

What was the outcome?

The results were compelling: the Active Choice design outperformed all others in eliciting permissions and improving consumer understanding and was therefore the design adopted. It led to a 2.2x larger marketable base and improved customer understanding by 30% compared to the existing design (Figure 2). The research findings gave the bank the confidence to conduct live trials, including an A/B test of the Active Choice design in a real account opening process. The results exceeded expectations, validating the research insights and building stakeholder consensus. The bank is now implementing the Active Choice design across all its customer journeys, closely guided by our recommendations.

Figure 2 – Example Behavioural RCT Results