Fill your Boots: The Return to the High Street

Posted: 08/06/2020

“Boots, Greggs and McDonald’s have the highest pent-up demand from frustrated UK shoppers”

This March, retail customers faced a hitherto unimaginable event. All non-essential shops, cafes, pubs and restaurants closed their doors, massively disrupting people’s long-established shopping routines. As the return of the High Street approaches, how has this disruption changed purchasing behaviour? Who will be going back to the High Street? And which brands will they go back to?

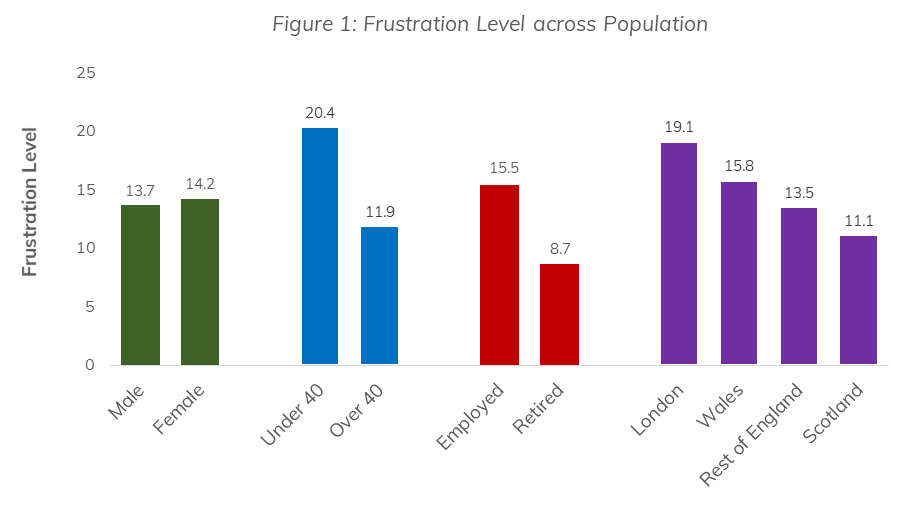

To address these questions, we measured how frustrated people are with not being able to visit specific stores. Figure 1 shows how this frustration aggregates across consumers. For example, both men and women are finding the lockdown equally annoying. But younger consumers and Londoners are finding the closures much more irritating than everyone else.

This may seem counter-intuitive since young people are more likely to have pre-existing online shopping repertoires. But younger consumers also tend to shop more often, meaning they experience the inconvenience of shop closures more frequently, an observation we return to presently.

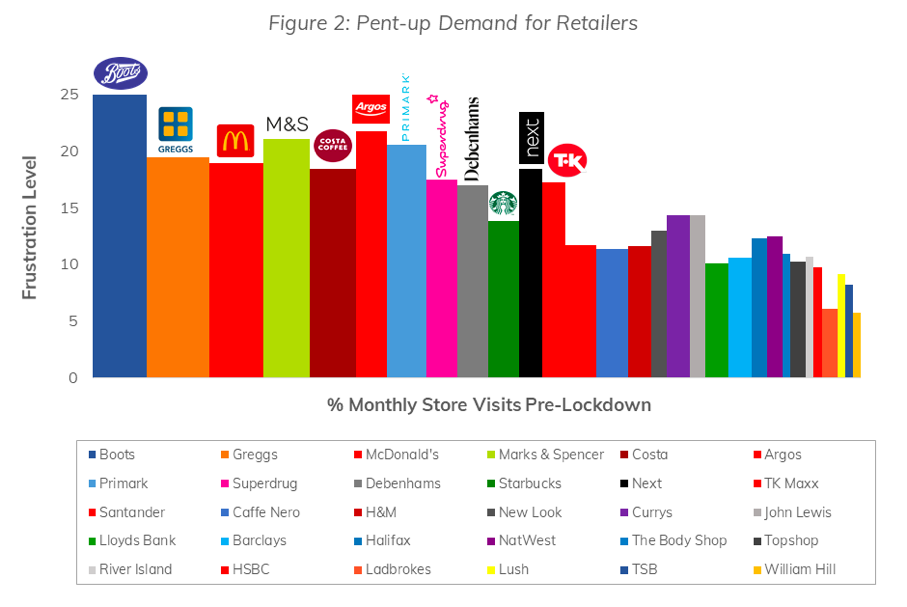

Figure 2 explores how this frustration plays out at a brand level. Focusing on the vertical Frustration Level axis, the partial closure of Boots has caused people the most inconvenience and, conversely, shuttering licensed betting offices has generated the least. Notably shoppers are struggling with the closure of Argos, M&S and Primark.

Primark is interesting since other brands have been able to partially offset their High Street losses with higher online sales. Hence, frustration with Primark has been intensified by their lack of an online channel, a disastrous decision in retrospect. Similarly, whilst Next does sell online, it was closed for weeks to reconfigure their supply chain.

The horizontal axis shows each brand’s share of pre-lockdown High Street footfall. There is a strong relationship between footfall (bar width) and frustration. People miss the places they used to spend time rather than, say, money. For example, consumers spent £10Bn at M&S last year, about 30% more than at Boots. But people visited Boots about 30% more than M&S. And it’s Boots they’re missing more.

The area of each bar is a measure of pent-up demand. To have a bigger bar means people are both in the habit of using your store and upset that it is closed. Pent-up demand therefore estimates how much footfall brands can anticipate once the lockdown is lifted. The stores have been ranked by this metric.

The bulk of pent-up demand is for food chains like Greggs, McDonald’s, and Costa. But post-lockdown demand is going to be muted by comparatively low levels of frustration, given prior footfall. People have to some degree found ways to live without them during the lockdown and some of these new habits will stick.

Conversely, there’s relatively high frustration levels with the closure of clothes stores like Primark, Next and TK Maxx. People want them to re-open more than their prior footfall implies. There’s no doubt that the pandemic has accelerated the migration to digital. But this research shows that people still miss physical. The High Street still has a role to play providing us with a coffee, a sausage roll, and a place to try on outfits.